Car Insurance Marketing: 3 Trends + 9 Strategies

insurance, conversational ai, iovox insights, conversational intelligence,

Car insurance marketing has gone beyond offering financial assistance solely for accidents.

Modern consumers are now searching for customized solutions that match their specific driving behaviors, preferences, and way of life.

They desire convenience, transparency, and personal interactions when dealing with insurance businesses.

How can you adapt to these rapid shifts?

No worries! We've got you covered!

Whether you own a motor insurance company or work as an insurance broker, we'll help you outpace the most significant insurance marketing trends using the ultimate conversational AI tool.

This Article Contains:

- 3 Disruptive Car Insurance Marketing Trends

- 4 Key Considerations for a Comprehensive Car Insurance Marketing Plan

- 9 Strategies for Car Insurance Marketing that Deliver Results

- How Can Conversational AI Amplify Your Car Insurance Marketing Efforts?

- Supercharge Your Car Insurance Marketing with iovox

Buckle up for an exciting ride!

3 Disruptive Car Insurance Marketing Trends

The shift in consumer preferences, new technology, data analytics, and regulatory influences have all significantly changed the automobile insurance market.

Let's examine how these trends have impacted auto insurance sales:

Evolving Car Ownership Trends

With platforms like Uber and Lyft, getting a ride has become much easier. This change has reduced the market size for personal car usage, especially in big cities where parking and dealing with traffic can be hard.

Additionally, as concerns about environmental sustainability grow, more people are choosing electric vehicles over gasoline cars.

Because of these changes, many insurance providers have shifted their focus to owners of car fleets (such as big companies) instead of individual owners. And many now offer specialized coverage to boost auto insurance sales.

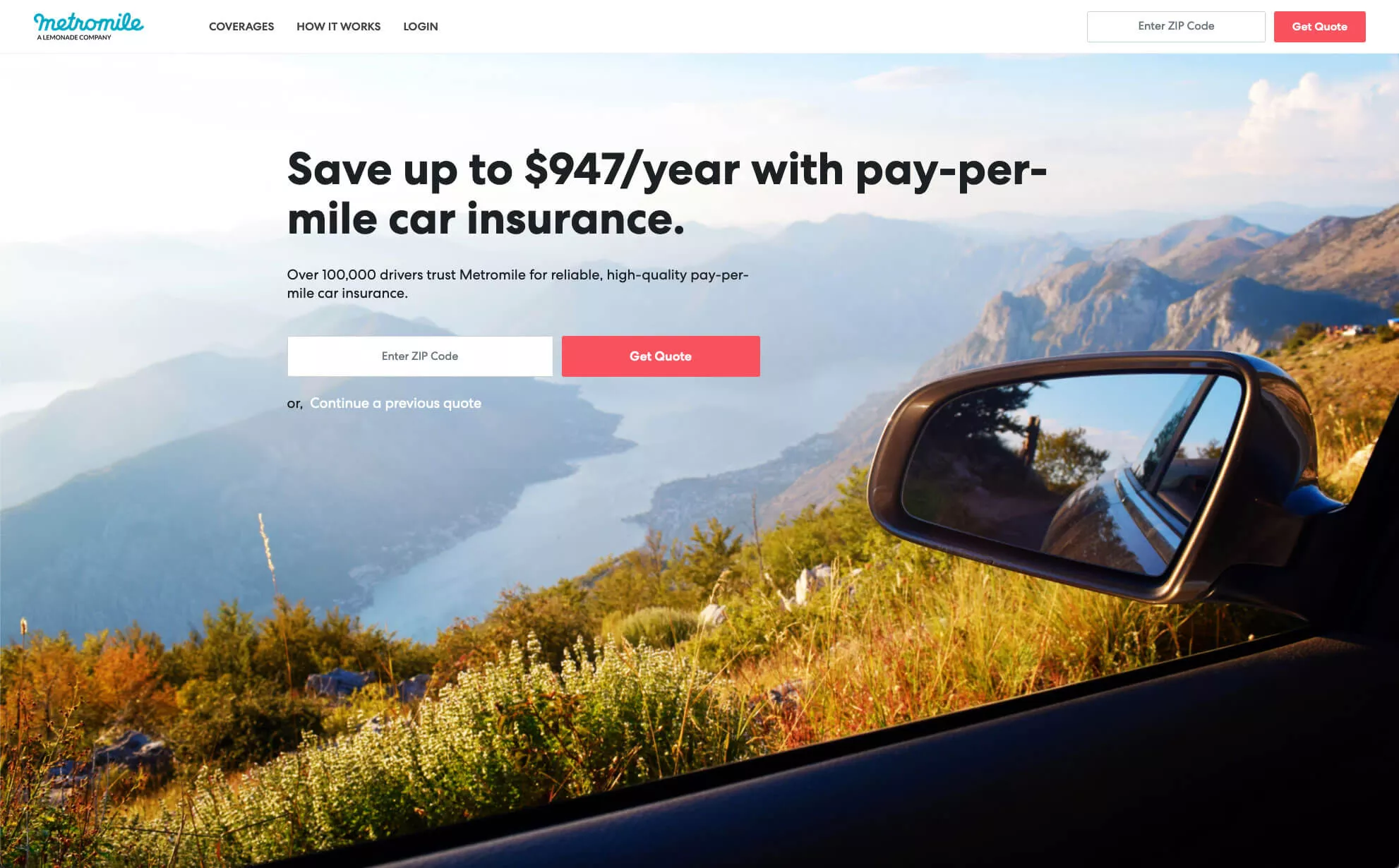

For instance, Metromile has introduced pay-per-mile insurance — a usage-based model based on mileage, driving times, and routes taken.

Similarly, Travelers gives insurance discounts to people with hybrid and electric cars. This is a way for the company to support the environment and show that they understand what their customers care about.

Data-Driven Coverage Models

Telematics enables auto insurance companies to collect real time vehicle data, including driving behaviors and usage patterns.

As a result, the auto insurance industry has progressed beyond considering only basic information, such as vehicle age, when assessing risk. Instead, insurers customize coverage based on driving style and attentiveness on the road.

The Snapshot program from Progressive gives you rates that match your driving habits. If you drive carefully, your rates could go down. But if your driving is risky, your rates might go up.

Personalized Digital Experiences

The COVID-19 pandemic triggered an unprecedented shift toward digital interactions across the global auto insurance market.

Now, customers expect easy-to-use digital platforms that allow them to manage their policies, make payments, and access important information online.

They also like timely updates about policy changes, claims, special offers, and other essential things.

To meet these changing needs, auto insurance companies use new technologies like conversational intelligence — a smart tech that uses machine learning and Natural Language Processing (NLP).

For instance, let's look at Kate — GEICO's virtual assistant. Kate can give advice and information about insurance prices to help people make smart automobile insurance choices. All customers need is the Geico app that enables 24/7 customer service.

Bottom line: The auto insurance industrychanges continually to meet customers' wants. Your car insurance company requires a well-structured plan to stay in stride with these dynamic shifts.

4 Key Considerations for a Comprehensive Car Insurance Marketing Plan

Here are four fundamental aspects of a robust insurance marketing strategy to ensure that your efforts effectively resonate with the people you want to reach:

Target Audience and Personas

People have diverse needs, preferences, and challenges.

For instance, a young driver might seek affordable insurance, while a family with multiple cars could prioritize comprehensive coverage.

As a car insurer, you can personalize your auto insurance products by acknowledging these specific needs.

How can you put this into action?

Review your customer database for information like age, purchase history, and engagement patterns.

Online surveys can also provide direct insights from customers. Ask about their preferences, challenges, and product needs.

For inspiration, consider how USAA focuses on military personnel and families. As a result, their marketing and messaging are designed to cater to this particular segment specifically.

Objectives and Key Performance Indicators

Define your company's goals, explain specific outcomes, and set realistic timeframes. This way, you can quickly track progress and pinpoint areas of improvement.

Consider breaking your goal into smaller tasks or milestones if it is complex.

Here's an example of a well-defined insurer goal:

‘Over the next 12 months, we aim to increase online insurance quote requests by 20% through targeted content marketing campaigns and improved website user experience. This initiative will boost customer engagement and ultimately increase market share.'

A clear goal inspires your team, directs their efforts, and helps your organization work collectively toward a common objective.

Unique Value Proposition (UVP)

Capture what makes your car insurance company stand out in a crowded auto insurance market.

Why should customers pick your auto insurance company over others?

Look at what your competitors offer and find ways to do something different with your UVP.

Find out what your car insurance company is good at, like giving excellent customer service, providing personalized coverage, being affordable, or using technology.

Allstate derives its UVP from a long-standing experience and reputation for providing simple yet reliable insurance coverage, encapsulated in its tagline, "You're in good hands."

Budget and Resources

Clarity about your budget helps set realistic expectations for the scope and scale of your marketing efforts.

Examine your marketing budget, team capabilities, tools, and available technology for effective marketing. Then, prioritize strategies and marketing channels that give you the most impact without costing too much.

For instance, if you're investing in multi-channel marketing or Google Ads focusing on driving conversions via phone calls, consider implementing Dynamic Number Call Tracking.

This feature enhances your ROI (return on investment) by allocating dynamic phone numbers to track and monitor prospects who visit your website.

With a sturdy framework laid out, you could be asking...

What's the most effective method to amplify revenue?

9 Strategies for Car Insurance Marketing that Deliver Results

Here are nine tried and tested strategies you can use to connect with your intended audience, advertise your insurance products and services, and boost your earnings:

Add Humor for a Memorable Experience

The auto insurance market can seem complicated and boring. That's exactly why incorporating humor can be a great marketing idea.

It helps make the information easier to understand and encourages consumers to like, comment, and share.

In one of their commercials, Geico used a song from the 1990s and changed the words to talk about their quick insurance process. The catchy music and funny words make it easy to remember and share with friends.

Take the Safety-First Approach

When safety takes precedence in your auto insurance marketing strategy, it communicates an overall urgency that encourages people to look up and take notice.

How can you achieve this?

Take a cue from the American Automobile Association (AAA). They run targeted campaigns, offer valuable resources, and use media outreach to educate the public about the importance of safe driving.

They also collaborate with the government, law enforcement, and transportation organizations on road safety initiatives.

Appeal to the Desire for Budget-Friendly Coverage

Affordable car insurance coverage focuses on delivering value.

To implement this insurance marketing strategy, auto insurers can:

- Present various coverage tiers, allowing individuals to pick what matches their budget.

- Extend discounts to those who secure multiple policies.

For instance, State Farm rewards clients who combine their life insurance, health insurance, home insurance, and vehicle insurance policies with discounts.

Additionally, leveraging conversational AI can enhance this strategy further. AI can gather information about their financial situation and insurance needs by engaging customers in conversation.

Based on this data, it can recommend policies that align with their budget and requirements, offering a personalized and cost-effective insurance solution.

Evoke Emotions Through Heartfelt Narratives

Vibrant storytelling is a powerful differentiator in a crowded automobile insurance market. It's about connecting with people on a personal level.

Nationwide uses Twitter to share stories that showcase their positive impact on people's lives and emphasize the company's human-centric approach to insurance.

Leverage Data Analytics and Targeted Advertising

Data-rich platforms like Facebook, LinkedIn, and Google Ads allow you to target high-quality insurance leads quickly with personalized ads across different channels.

Moreover, these platforms give you complete control over your budget through pay-per-click advertising. With PPC advertising, you only pay when someone clicks on your ad.

And there's more.

When customers show interest in automobile insurance but don't complete the purchase, you can retarget them.

For example, if a potential client adds an auto insurance policy to their cart but leaves without buying, retargeting can remind them and encourage a purchase.

Similarly, if a user examines specific insurance policy details like coverage options or pricing, retargeting can show them related ads, refreshing their memory.

Develop Informational and Educational Content

Use content marketing to tackle customer worries, establish expertise, and enhance engagement. However, you must choose the correct content format and platform.

Here are some practical tips:

- Informative blog posts: Publish comprehensive blogs or e-books about policy details and coverage choices. You can also offer practical tips for new vehicle owners.

- Engaging social media posts and videos: Use infographics and short videos on Facebook, TikTok, and Instagram to share insurance stats and facts.

- Interactive webinars: Conduct live talks on Zoom, Facebook, or Instagram. Get experts to discuss insurance details, changing policies, and saving money.

- Email newsletters: Send emails with bits from helpful blog posts, news, and special deals. Use these emails to attract people to your main website.

- Customer testimonials: Share stories of how your insurance helped after accidents or how significant service fixed problems on your website and social media.

Implement Search Engine Optimization (SEO) Strategies

SEO ensures your website or content appears at the top in car insurance-related search engine results.

This can boost your brand awareness and encourage meaningful interactions with a potential customer who is already interested.

However, good SEO is not limited to the content and information on your website.

Here are some fundamentals to keep in mind:

- Keyword Research: Conduct market research and find the words and phrases people use when searching for things related to auto insurance.

- Content Strategy: Plan and create useful content like articles, guides, videos, and infographics around relevant keywords, like coverage for commercial vehicles, cheap vehicle insurance, liability coverage options, and more.

- Technical SEO: Ensure your website is easy for users to navigate, loads quickly, is mobile-friendly, and has simple and neat web addresses or URLs.

- Link Building: Get other trustworthy websites to link back to your auto insurance site.

- Local SEO: Optimize your online presence for local searches with a Google Business Profile and positive local reviews.

In addition to these techniques, consider implementing 'WebConnect' to optimize for conversions. This feature facilitates direct and immediate interactions with potential customers, improving your chances of converting website visitors into clients.

Lastly, keep track of website traffic metrics, user behavior, and keyword performance using tools like Google Analytics. Use this data to make continuous improvements.

Partner with Influencers and Other Brands

Relevant partnerships with influencers and brands can help you swiftly tap into new audiences and establish meaningful connections.

For example, you could team up with a travel influencer who could narrate a real-life incident about how good coverage helped during a road trip.

Similarly, you can collaborate with brands like yours, like a road safety non-profit, a ride-sharing platform, or a local community support group. Sponsoring events for them or advertising on their platforms can be a rich source of leads from people who realize the importance of car insurance.

Liberty Mutual Insurance partnered with car manufacturer Subaru to introduce the Liberty Mutual RightTrack in-car app. This groundbreaking application provides immediate driving feedback and advice, contributing to lower insurance costs for responsible drivers.

Use Multi-Channel Marketing

Some people might enjoy reading emails, while others prefer visual content on social media.

A multi-channel strategy allows auto insurers to accommodate these varying preferences.

Here's how it would work:

- Social media: Use social media platforms like Instagram, TikTok, and YouTube to talk to your audience about driving safely. You can also educate them about auto insurance products and share news about the insurance industry.

- Email: Maintain direct communication with your insurance consumers by sending timely email newsletters on new plans, special offers, and valuable insurance tips.

- Consumer Forums: Join conversations on sites like Reddit and Quora, where people ask for advice about auto insurance. Answer their questions as an expert instead of a salesperson pushing an insurance product.

- Local events: Host seminars on safe driving practices, offer insurance education sessions, and share insights about local driving trends. Work with schools, community centers, or local businesses to reach more people and build strong connections.

The best auto insurance marketing strategy uses a balanced combination of many or all of the approaches mentioned in the list above.

However, casting such a wide net can usually be a strain on your marketing team. Plus, you should know which channels bring in the most qualified leads.

For instance, Abeille Assurances employed innovative call tracking solutions to accurately connect conversions originating from offline marketing campaigns.

The outcome?

Not just a cost reduction, but also a noticeable increase in high-quality leads.

This transformation is particularly evident when these solutions are powered by conversational AI.

How Can Conversational AI Amplify Your Car Insurance Marketing Efforts?

Conversational AI combines artificial intelligence, natural language processing, and machine learning to understand and respond to human input, whether text or speech.

It can answer questions, provide information, perform tasks, and even simulate real time human conversation. More importantly, it learns from interactions, making its responses more accurate and contextually appropriate.

Let's explore how this can boost your digital marketing efforts and customer satisfaction:

Deliver Round-the-Clock and Multi-Channel Customer Support

AI-powered chatbots ensure your customers receive accurate responses at all times.

Imagine a scenario where a customer has a question about their policy, even late at night. They visit your motor insurance company's website and engage with a chatbot to find fast and accurate answers.

It doesn't matter how many questions come in. A chatbot can handle multiple chats simultaneously and deliver accurate results each time.

What's more, these chatbots seamlessly operate across diverse platforms such as websites, social media, and messaging apps.

Use Customer Data to Offer Personalized Recommendations

Conversational AI can extract valuable insights from customer interactions to comprehend their preferences and provide tailored recommendations.

For example, the chatbot or virtual assistant can recommend a usage-based pricing policy when prospects inquire about budget-friendly insurance coverage for occasional city driving.

It can also pick up on demographic details, such as whether they're homeowners or are married, to suggest a bundle that suits their requirements.

But that's not all.

Imagine a scenario where a customer wants to compare different collision coverage options. Here, conversational AI takes another step by comparing and highlighting policy offering details like deductibles, benefits, and costs.

Provide Efficient Claims Processing

Whether it's guiding policyholders through claims initiation, offering real time updates, or tailoring assistance, conversational AI covers it all.

After verifying their account, the virtual assistant can:

- Gather essential details and start the claims process.

- Help customers in compiling required claim documentation.

- Walk them through forms, photos, and necessary information to ensure accurate submissions.

For instance, if a customer needs to submit photos of their damaged vehicle, the conversational AI provides step-by-step instructions for capturing and uploading clear images.

It can also expedite claims for minor accidents, like those for a cracked windshield. This frees up human resources for more complex cases.

Ready to discover the game-changing conversational AI solution?

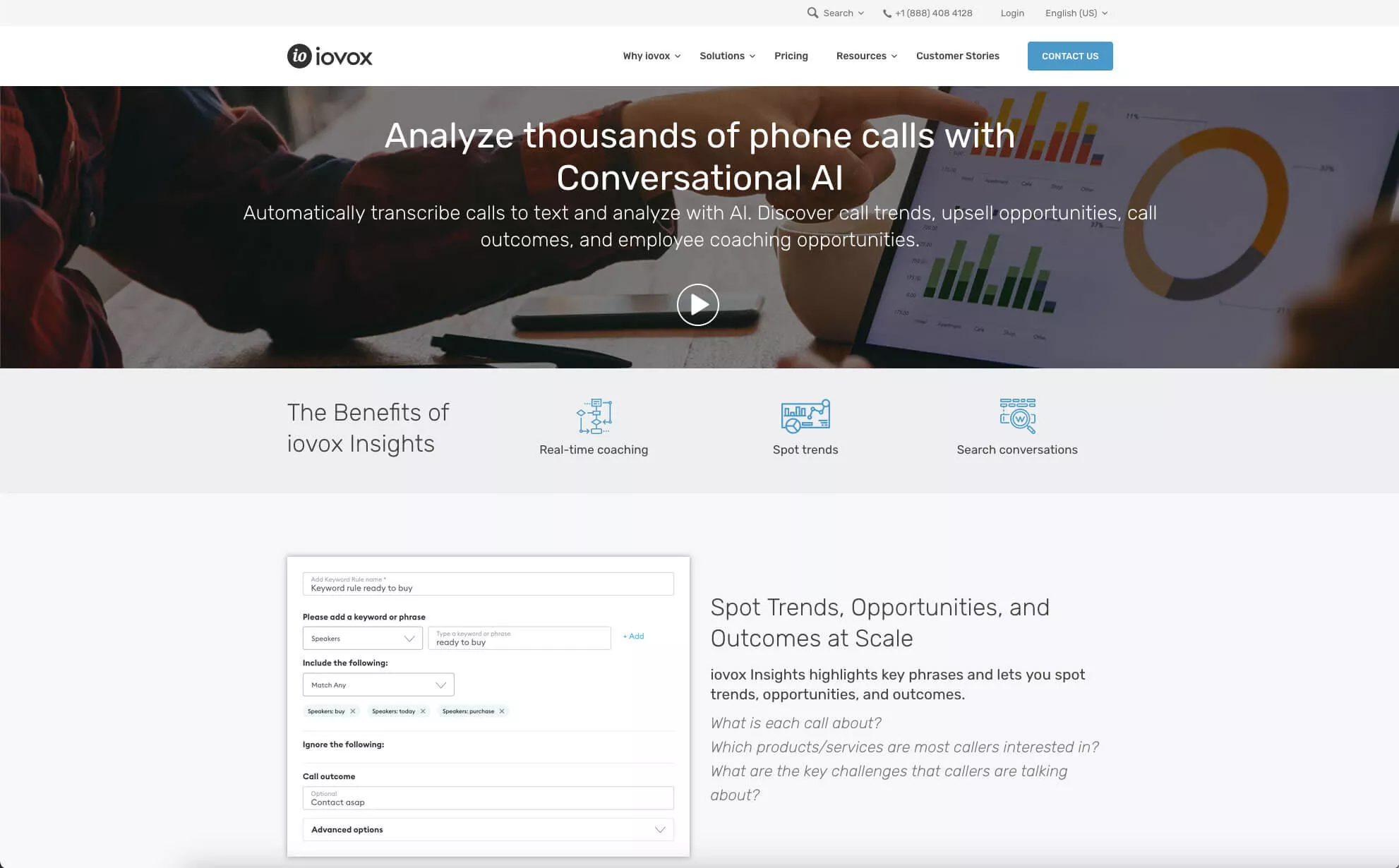

Introducing iovox Insights.

Supercharge Your Car Insurance Marketing with iovox

With advanced call tracking, transcription, and conversational AI, iovox can elevate lead conversion rates, customer retention, and satisfaction, and precisely identify trends.

It can help you rapidly expand your marketing endeavors and expand your revenue. Here's how:

Boost Lead Conversions

With iovox's Advanced Call Tracking, you can assign dedicated phone numbers to each marketing campaign.

This empowers you to monitor which distribution channels drive the most calls.

For instance, if you're running a marketing campaign on social media promoting discounted rates for safe drivers, you can use Dynamic Numbers to track your website visitors.

Each visitor or session gets a unique number assigned to them. As a result, you can accurately attribute phone calls or inquiries to specific marketing campaigns, traffic sources, or individual visitors.

You can then compare call volumes from various campaign numbers and precisely assess each campaign's impact.

This data-driven approach lets you decide where to invest your marketing budget for optimal lead generation and conversion.

Improve Customer Experience

iovox call analytics provides valuable information about how clients behave, what they prefer, and where they encounter difficulties.

By analyzing call patterns, you can:

- Discover the most frequent questions or issues customers raise.

- Ensure customers connect with the right experts for efficient assistance.

- Evaluate the overall happiness of customers during their calls.

- Detect where each insurance agent excels or needs further support.

For example, when analytics show that particular insurance agents are adept at addressing specific questions, you can route calls to these capable agents to ensure exceptional help.

Likewise, if analytics highlight that new customers often find specific insurance policy details confusing, you have the opportunity to provide targeted training to insurance agents.

This training improves their skill in explaining these details clearly, leading to more positive experiences.

Spot Upselling and Cross-Selling Opportunities

Conversational AI, a standout feature of iovox, goes beyond mere assistance. It actively learns and understands customer preferences and pain points comprehensively.

Consider a scenario where a customer calls to inquire about adding a new driver to their car insurance policy. Conversational AI captures intricate details about customers' unique requirements and driving habits.

When this customer contacts your insurance agency in the future, the representative has a wealth of information at their fingertips.

This transforms routine interactions into insightful and tailor-made engagements that leave a lasting positive impact.

Final Thoughts

Success in the auto insurance industry is about adapting to car ownership shifts, using data-driven coverage, and offering personalized digital interactions are essential.

On top of that, you must expertly blend established insurance marketing ideas with creative approaches.

That's where a game-changing solution like iovox is necessary to gain a comprehensive insight into all marketing activities.

iovox enables you to harness the power of data-driven insights acquired from customer interactions.

This lets you understand customer pain points, market segmentation, and emerging trends.

To explore more about iovox, click on the iovox WebConnect call button on this page to connect with us.

You can also contact us via email at hello@iovox.com or by visiting https://www.iovox.com/contact.

For toll-free assistance within the United States, dial +1 888 369 9519.

If you're outside the US, reach out to us using the numbers:

London, UK +44 (0)20 7099 1070

Sydney, Australia +61 (0)2 8520 3530

Paris, France +33 (0)1 84 88 46 40